Trending Now

Saturday, Jul, 2024

Home / Biden Announces Big Student Loan Forgiveness Plan

Biden Announces Big Student Loan Forgiveness Plan

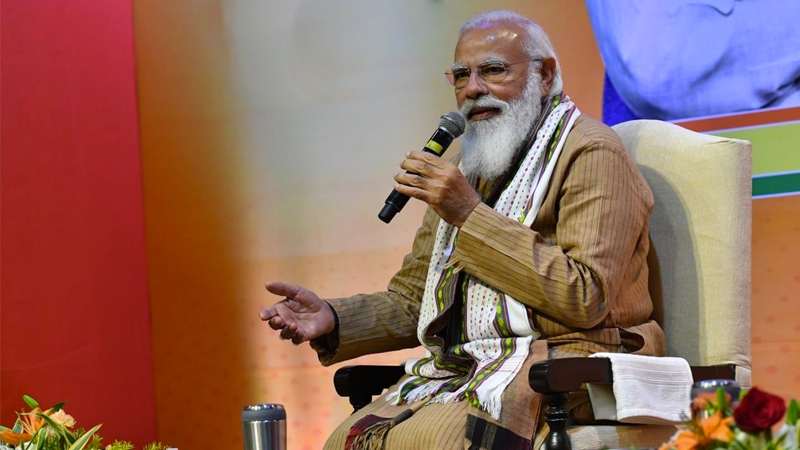

On Wednesday, President Joe Biden declared his long-awaited plan to deliver on a campaign promise to offer $10,000 in student debt cancellation for millions of Americans and up to $10,000 more for those with the greatest financial need, along with new techniques to lower the load of repayment for their remaining federal student debt.

by Pragti Sharma /

by Pragti Sharma /  26 Aug 2022 16:01 PM IST /

26 Aug 2022 16:01 PM IST /  0 Comment(s) / 271

0 Comment(s) / 271

Image Courtesy : www.facebook.com/POTUS

On Wednesday, President Joe Biden declared his long-awaited plan to deliver on a campaign promise to offer $10,000 in student debt cancellation for millions of Americans and up to $10,000 more for those with the greatest financial need, along with new techniques to lower the load of repayment for their remaining federal student debt.

President Biden announced in his tweet that families earning less than $25,000 and borrowers earning less than $125,000 per annum would be eligible for the $10,000 lean forgiveness. For recipients of Pell Grants- reserved for undergraduates with the most significant financial need, the federal government would cancel up to an additional $10,000 in federal loan debt. Biden is also expanding a pause on federal student loan payments, which he called the final time through the end of 2022. He was ready to deliver remarks Wednesday afternoon at the White House to disclose his proposal to the public. If his plan outlasts legal challenges that are most inevitable to come, it could provide a windfall to a swath of the nation in the run-up to this fall's midterm elections.

According to federal data, more than 34 million people have federal student debt, with an average balance of $37,667. About a third of borrowers owe less than $10,000, and half owe less than $20,000. The White House assumes that the announcement by Biden would erase the federal student debt of about 20 million people. Exponents say cancellation will restrain the racial wealth gap- Black students are more likely to borrow federal student loans at higher amounts than others. According to a Brookings Institution study- after earning a four-year bachelor's degree, black borrowers owe an average of nearly $25,000 more than their white peers. Still, the action is far-fetched to fascinate any coalitions that have been jostling for influence as Biden weighs how much to cancel and for whom. Biden has confronted pressure from liberals to offer broader relief to hard-hit borrowers and from moderates and Republicans challenging the fairness of widespread forgiveness. The delay in Biden's decision only heightened the expectation of what his inferiors acknowledge symbolizes a political no-win situation. The people spoke on the circumstances of obscurity to discuss Biden's planned announcement ahead of time.

The White House underlined that no one in the top percent income would see any loan relief. The continuance of the COVID-19 pandemic payment freeze comes just days before millions of Americans were ready to find out when their upcoming student loans will be due. It is the closest the administration has come to hitting the end of the payment freeze extension, with the contemporary pause set to end on August 31. Details of the plan have been preserved and closely protected as Biden weighed his options. The administration said that on Wednesday, the Education Department would release information in the following weeks for qualified borrowers to sign up for debt relief. Cancellation for some would be automatic if the department has access to their income information, but others would require them to fill out a form. Current students would only be eligible for relief if their loans developed before July 1, 2022. Biden is also offering to limit the amount that borrowers must pay monthly on undergraduate loans to 5% of their earnings.

The Education Department is to post a proposed rule to that effect which would also shield the unpaid monthly interest for borrowers who stay contemporary with their monthly payments- even when the payments are $0 because their incomes are lower. During the 2020 presidential campaign, Biden was initially suspicious of student loan debt cancellation as he faced off against more refined candidates for the Democratic nomination. Sens. Bernie Sanders, I-Vt., and Elizabeth Warren, D-Mass., had proposed cancellations of $50,000 or more. As he tried to shore up aid among younger voters and design for a general election battle against President Donald Trump, Biden disclosed his initial proposal for debt cancellation of $10,000 per borrower, with no word of an income cap. Biden strangled his campaign promise in recent months by embracing the income limit as gliding inflation took a political toll and as he desired to head off political invasions that the cancellation would profit those with higher take-home pay. But Democrats, from members of the congressional leadership to those confronting challenging reelection bids this November, have pushed the administration to go as wide as possible on debt relief, seeing it in part as a galvanizing problem, especially for Black and young voters this fall.

On Wednesday, in a joint statement with Senate Majority Leader Chuck, Warren stated that the positive influences of this move would be felt by families across the country, specifically in minority communities, and is the most effective action that Biden can take on his own to satisfy working families and the economy.

Although Biden has changed the plan from what he initially proposed during the campaign. A Democratic pollster who worked with Biden during the 2020 election, Celinda Lake, said that Biden would get a lot of credit for following through on something he was committed to. A survey of 18 to 29 years olds organized by the Harvard Institute of Politics in March discovered that 59% of those polled favored debt cancellation of some sort- whether for all borrowers or those most in necessity-although student loans did not rank among problems that most concerned people in the age group.

Some advocates say that plan still falls short. The president of the NAACP, Derrick Johnson, said that if the rumors are true, we have got a problem. He aggressively lobbied Biden to take bolder action and added that President Biden's decision on student debt cannot become the latest instance of a policy that has left Black people- particularly Black women, behind.

He added that this is how you treat Black voters who turned out in record numbers and offered 90 percent of their vote to once again save democracy in 2020.

Meanwhile, Republicans witness a political upside if Biden seeks a large-scale cancellation of student debt ahead of the November midterms, expecting backlash for Democrats, especially in states in which there are enormous numbers of working-class voters without college degrees. Analysts of broad student debt forgiveness also acknowledge it will open the White House to lawsuits because Congress has never given the president the unambiguous authority to cancel debt on his own.

On Tuesday, the Republican National Committee blasted Biden's anticipated announcement as a handout to the rich, claiming it would unfairly saddle lower-income taxpayers and those who have paid their student loans by wrapping the expenses of higher education for the wealthy. Biden's lengthy deliberations have led to grumbling among federal loan servicers, who had been demanded to hold back billing statements while Biden weighed a decision. An executive director of Student Loan Servicing Alliance, Scott Buchanan, stated that Industry groups had whined that the delayed decision exited them with just days to notify borrowers, retrain customer service employees, and update websites and digital payment procedures. This would raise the risk that some borrowers will unintentionally be told to make payments. He added that at this stage, I think that is the risk we are running. You cannot just turn on a dime with 35 million borrowers with different loan types and statuses.

Blog / February 11, 2024

Mastering Spoken English: A Journey Through Real-Life Conversations

Blog / January 19, 2024

The Crucial Need for Cybersecurity Education in School Curriculums

Blog / December 19, 2023

How Gamification Transforms Learning into Adventure

Blog / December 01, 2023

Empowering Education: How Artificial Intelligence Shapes the Future of Learning

Blog / September 10, 2023

Looking for Scholarships? 3 Programmes to Apply for by September-October 2023

Blog / May 11, 2023

Top 10 Career Choices for Generation Z

EShort / February 16, 2024

IMS Noida Admissions 2024: Apply for UG, PG programmes

EShort / February 16, 2024

GATE 2024: Response sheet out

EShort / February 16, 2024

BSSTET 2023: Admit card released

EShort / February 16, 2024

NID DAT 2024: Prelims result released

EShort / February 16, 2024

IIT JAM 2024: Response sheet released

Jobs / February 16, 2024

UPSC Recruitment Drive 2024: Apply for 120 vacancies in various departments

EShort / February 14, 2024

UPSC CSE 2024: Official Notification issued; application process begins

Editor's Desk / April 17, 2020

How Does Society Impact Our Education?

Current Affairs / April 22, 2020

Mr. Sudarsanam Babu appointed to U.S. Science Board.

Reforms / April 17, 2020

Traditional Structure of Education In India

.jpg)

Events & Seminars / April 17, 2020

PISA!!

Blog / February 26, 2021

Government's Action On #ModiRojgaarDo

EShort / May 19, 2022

CUET PG 2025 has started the registration process.

Notice Board on Important Dates / April 21, 2020

World Heritage Day

News / July 08, 2021

JEE Mains Registration For Session 3: Last Date To Apply

EShort / June 11, 2022

KCET 2022 registration reopen today

0 Comments

Post Comments