Trending Now

Thursday, Nov, 2024

Home / Central Govt To Raise Guarantee Limit For Education Loan To Rs. 10 Lakh

Central Govt To Raise Guarantee Limit For Education Loan To Rs. 10 Lakh

CGFSEL- Central government's Credit Guarantee Fund Scheme for Education Loans guarantees education loans. According to the scheme, a student can have an education loan without any third-party guarantee and collateral security up to the highest loan amount of Rs.7.5 lakh.

by Pragti Sharma /

by Pragti Sharma /  15 Oct 2022 13:31 PM IST /

15 Oct 2022 13:31 PM IST /  0 Comment(s) / 392

0 Comment(s) / 392

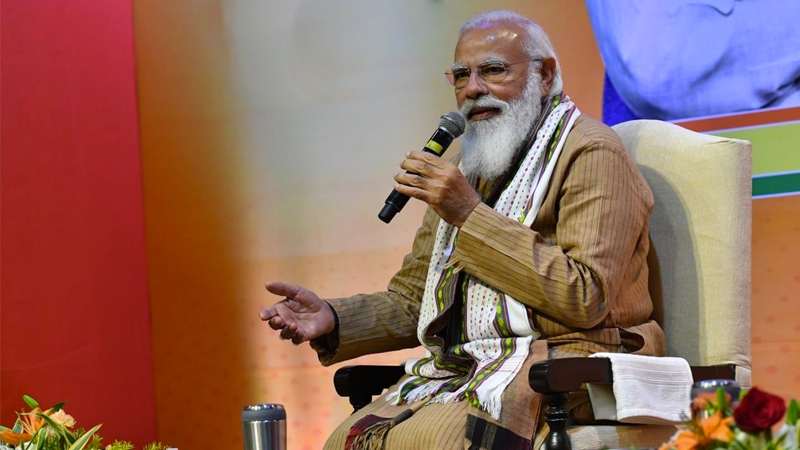

The central government is likely to raise the guarantee limit for education loans by 33% to Rs. 10 lakh from the existing Rs. 7.5 lakh.

CGFSEL- Central government's Credit Guarantee Fund Scheme for Education Loans guarantees education loans. According to the scheme, a student can have an education loan without any third-party guarantee and collateral security up to the highest loan amount of Rs. 7.5 lakh.

Ministry of Finance- the Department of Financial Services will be consulting with the Education Ministry to increase the maximum guarantee limitation to Rs. 10 lakh. The fixed-guarantee limit could be increased to Rs. 10 lakh or even heightened.

In August, the Department of Financial Services carried out a meeting with all the 12 government-owned banks to discuss disbursal targets of education loans.

During the meeting, a bank official asked the department to bring uniformity in the guarantee limitation on educational loans. The bank official emphasized that while the central government's CGFSEL scheme offers a guarantee for education loans up to Rs. 7.5 lakh, some state governments had fixed up to Rs. 10 lakh as the guarantee limit.

CGFSEL- Central government's Credit Guarantee Fund Scheme profits students who come from the Economically Weaker Section (EWS).

The annual gross family income of the student who wants to take an education loan should not be over Rs. 4.50 lakh. The interest rate set by the lender for education loans under the CGFSEL scheme can only be up to 2% per annum over the base rate.

In addition, students from the Economically Weaker Section (EWS) can also claim full interest subsidy for these loans during the moratorium period, which is the whole course period plus one year. The subsidy is offered for the maximum loan amount of 7.5 lakh.

News Source: NDTV

EShort / February 16, 2024

IMS Noida Admissions 2024: Apply for UG, PG programmes

EShort / February 16, 2024

GATE 2024: Response sheet out

EShort / February 16, 2024

BSSTET 2023: Admit card released

EShort / February 16, 2024

NID DAT 2024: Prelims result released

EShort / February 16, 2024

IIT JAM 2024: Response sheet released

Jobs / February 16, 2024

UPSC Recruitment Drive 2024: Apply for 120 vacancies in various departments

EShort / February 14, 2024

UPSC CSE 2024: Official Notification issued; application process begins

Editor's Desk / April 17, 2020

How Does Society Impact Our Education?

Current Affairs / April 22, 2020

Mr. Sudarsanam Babu appointed to U.S. Science Board.

Reforms / April 17, 2020

Traditional Structure of Education In India

.jpg)

Events & Seminars / April 17, 2020

PISA!!

Blog / February 26, 2021

Government's Action On #ModiRojgaarDo

EShort / May 19, 2022

CUET PG 2025 has started the registration process.

Notice Board on Important Dates / April 21, 2020

World Heritage Day

News / July 08, 2021

JEE Mains Registration For Session 3: Last Date To Apply

EShort / December 14, 2021

UPSC Declared Final Result For DCIO Recruitment

0 Comments

Post Comments